We constantly hear “Company X bought Y for billions of dollars” in the news. We often later hear that “Company X has made a big loss acquiring Y, as it was overvalued”. The envisaged gain in a company merger rarely happens and, in fact, quite often becomes a loss for the acquiring company. Top managers resign and it takes years to repair the company image and build shareholder value to the level it was.

Do companies really know what they are buying and how it will integrate into their company infrastructure? Will it undermine the growth of the existing operation to focus on a new track? Are apples and pears compatible or not? It would certainly help knowing what you are buying, beyond the bubble of propaganda created in the acquisition process.

Take press coverage on www.investopedia.com, for example:

“Leading microchip maker Intel has announced it intends to buy Altera in a deal worth $16.7 billion. The deal will allow Intel to expand its product line to include Altera’s unique range of products, including programmable logic devices (PLDs), highly integrated power devices, pre-defined design building blocks, and development software. PLDs consist of field-programmable gate arrays (FPGAs), which are microchips that the company’s customers program to perform specific desired logic and processing functions in their electronic systems….”

How sure are they this will work? Well, surely they have analyzed their needs and how much the add on in their product range might economically benefit their operations, as well as calculated the potential integration cost, how many people they can lay-off etc. They have done a compatibility analysis using consultants. It has been serious work but the risk of error is always very high. Who doesn’t remember Hewlett Packard buying Autonomy?

What if each company was fingerprinted, with analysis carried out by merging these fingerprints? We can currently do economic fingerprinting if companies use the same or similar accounting systems. What if this was taken one step further and production, sales, and HR were mapped into a structure that could be analyzed and processed, creating hypothetical scenarios, analyzing pros and cons? Is this a dream or can it really be done?

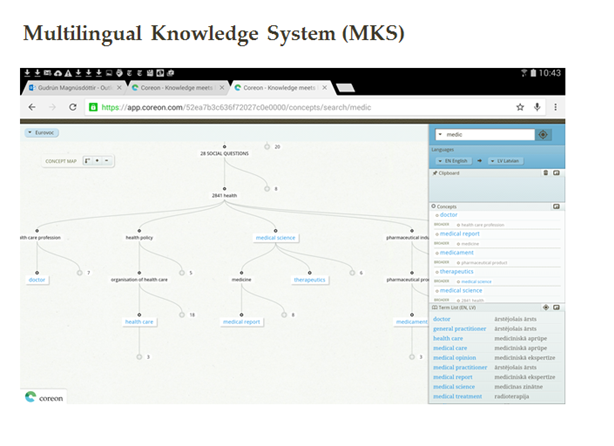

Yes, it can! Today’s technology is able to perform such an analysis as long as both companies have maintained proper information infrastructures. These, combined with data driven methods, can provide the critical answers. The key is that the information structures are integrated into a Multilingual Knowledge System, as shown below. Companies will want to develop such an information structure for internal efficiency and higher revenues, but also to be more valuable in mergers.

If companies are working in different languages, a Multilingual Knowledge System helps in joining the information infrastructures.

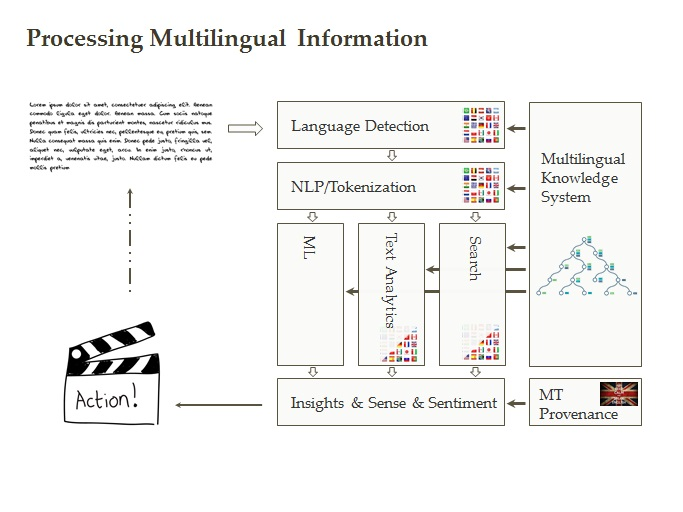

If the companies are working in different languages, the multilingual knowledge system helps in joining the information infrastructures. In this case, multilingual processing support by Machine Translation is necessary.

A good search based on those fingerprints diving into company documentation in multiple languages provides the basis for the analysis. The analytics of the two fingerprints combined with the results from the documents will tell you more than any number of human analysts ever can:

No more costly mistakes! Start your acquisition with a knowledge base about the firm you want to acquire! Insist on having knowledge structures at the basis of your information!

You will find more information at www.coreon.com.

*Feature Image: Business photo created by yanalya – www.freepik.com